North Dakota Tax Refund 2004-2026

What is the North Dakota Tax Refund

The North Dakota tax refund refers to the amount of money that residents may receive back from the state after filing their taxes. This refund can result from overpayment of state taxes, eligibility for tax credits, or deductions that reduce overall tax liability. Understanding the components that contribute to the refund amount is essential for taxpayers, as it can help in planning finances and ensuring compliance with state tax regulations.

Steps to complete the North Dakota Tax Refund

Completing the North Dakota tax refund involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099s, and any other relevant income statements. Next, fill out the appropriate tax forms, such as the North Dakota individual income tax return. Ensure that you claim any eligible deductions and credits. After completing the forms, review them for accuracy before submitting them either electronically or by mail.

Eligibility Criteria

To qualify for the North Dakota tax refund, taxpayers must meet specific eligibility criteria. This includes being a resident of North Dakota for the tax year in question and having filed a complete and accurate state tax return. Additionally, individuals must have paid more in state taxes than they owe, which can be determined through the tax return calculations. Certain income thresholds and filing statuses may also affect eligibility for specific tax credits that can increase the refund amount.

Required Documents

When applying for the North Dakota tax refund, it is crucial to have all required documents ready. Essential documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Proof of any tax credits claimed

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents organized will streamline the filing process and help ensure that all relevant information is included.

Form Submission Methods

Taxpayers can submit their North Dakota tax refund forms through various methods. The primary options include:

- Online submission via the North Dakota tax portal

- Mailing the completed forms to the appropriate state tax office

- In-person submission at designated tax offices

Choosing the right submission method can impact the processing time of the refund, with online submissions typically being the fastest option.

Legal use of the North Dakota Tax Refund

The North Dakota tax refund is legally binding when filed according to state regulations. It is essential for taxpayers to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or delays in receiving the refund. Understanding the legal implications of the refund process helps taxpayers navigate their responsibilities and rights effectively.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for taxpayers seeking a North Dakota tax refund. Generally, the deadline for filing state tax returns is April fifteenth of each year. However, taxpayers should check for any changes or extensions that may apply. Missing the deadline can result in penalties or the loss of the opportunity to claim a refund, making it important to stay informed about significant dates in the tax calendar.

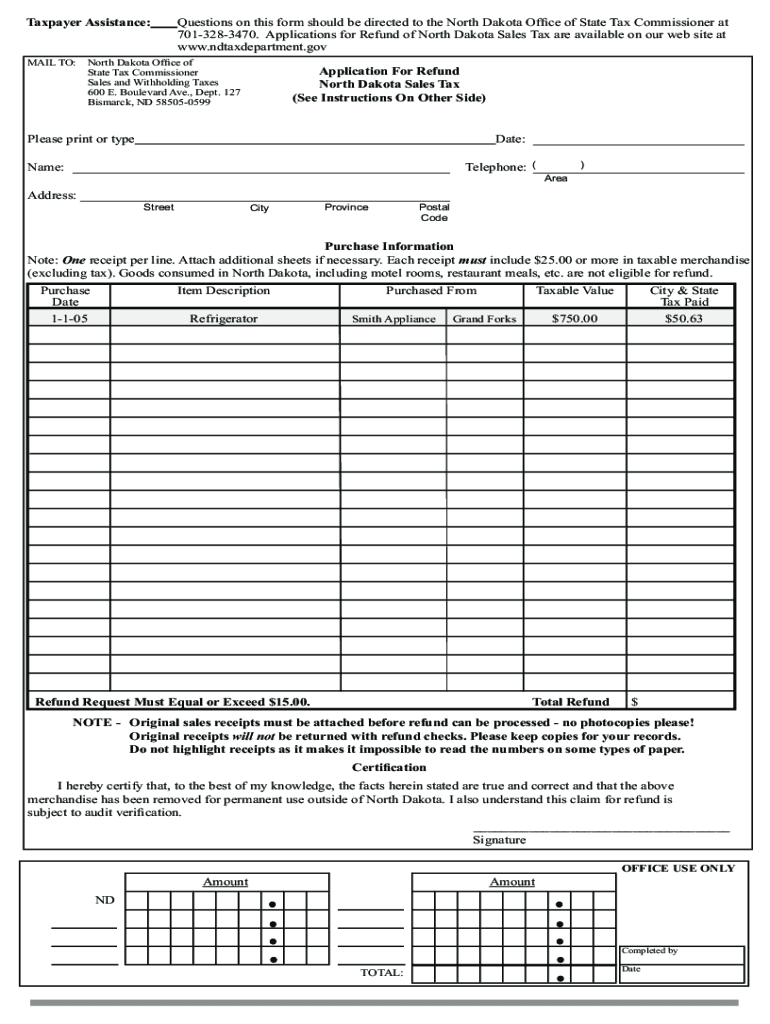

Quick guide on how to complete north dakota tax refund for canadian residents form

Complete North Dakota Tax Refund effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage North Dakota Tax Refund on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign North Dakota Tax Refund effortlessly

- Locate North Dakota Tax Refund and click on Get Form to commence.

- Use the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, through email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow takes care of your document management needs with just a few clicks on any device of your choice. Edit and eSign North Dakota Tax Refund and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form does a J1 visa student who worked over the summer need to fill out to get a tax refund from the US government?

You need form 1040NR (or 1040NR-EZ) and form 8843.See Publication 519 (2014), U.S. Tax Guide for Aliens for some help as well as Page on irs.gov. You may have to file a nonresident state tax return as well but that depends on your state.Be careful when using web-based software (such as TurboTax) because not all of them support nonresident forms.

-

Some large USA institutions want me to fill a W8 Form. I am a Canadian. What tax implications does this have for me? Would it affect me in the future? What happens after I fill it out?

That is dependent upon if you are working as an employee for that company(/ies). It’s similar to a W-4 form, which most American’s are more familiar with but designed for non-US Citizens who are working in the US or a nation that has a tax treaty with the US.This is a more indepth link from the IRS. Who needs to fill out IRS tax form W-8?

-

Is there a Canadian equivalent to form I-9, which all US jobholders must fill out to prove legal residency in the US?

Thanks for the A2A, John.The question is: “"Is there a Canadian equivalent to the I-9, which all US jobholders must fill out to prove legal residency in the United States.”Jeff provided a very good response. Everyone who is employed must have a SIN number. Everyone over the age of 18, and therefore legally obliged to file income taxes whether or not (s)he has an income, must have a SIN number. While there is no obligation for minors to have a SIN number, many parents will apply for SIN numbers for their children, especially if they have RESPs (Registered Education Savings Plan) because the federal goverment will also contribute to the savings in the child’s RESP.Employers must ask for and record the SIN number of every employee. Employers must provide each employee with a statement of income that includes the SIN number.SIN numbers are only required by a few government agencies, and even fewer private organizations (e.g., banks) and then only (ultimately) for tax purposes.Canadians are discouraged from using their SIN number in any other context. The SIN number is considered a sensitive identifier and not to be used lightly. Indeed, most government agencies are not allowed to ask for a person’s SIN number. See: Protecting your Social Insurance NumberYou must have a SIN number to be legally employed in Canada. In order to obtain a SIN number you must be a Canadian citizen, or a permanent resident, or a legal temporary resident (e.g., on a work visa). (See What documents do I need to apply for a Social Insurance Number (SIN)? )The upshot is that, once the employer knows you have a valid SIN number, it is assumed that you are legally entitled to work. The employer would know if your SIN is valid because (s)he has to submit payroll taxes and ensure that appropriate income taxes are paid on your behalf. If the SIN number is not valid, Revenue Canada will let your employer know pretty quickly!Edit: added “not”: Indeed, most government agencies are NOT allowed to ask for a person’s SIN number.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the north dakota tax refund for canadian residents form

How to create an eSignature for the North Dakota Tax Refund For Canadian Residents Form online

How to make an electronic signature for your North Dakota Tax Refund For Canadian Residents Form in Chrome

How to create an electronic signature for putting it on the North Dakota Tax Refund For Canadian Residents Form in Gmail

How to make an electronic signature for the North Dakota Tax Refund For Canadian Residents Form from your mobile device

How to make an eSignature for the North Dakota Tax Refund For Canadian Residents Form on iOS devices

How to make an electronic signature for the North Dakota Tax Refund For Canadian Residents Form on Android

People also ask

-

What is the process for obtaining my ND state tax refund?

To obtain your ND state tax refund, you need to complete your tax return accurately and file it with the North Dakota Office of State Tax Commissioner. Ensure that all necessary documents are included and that you meet the filing deadlines. Tracking your ND state tax refund can be easily done online once your return has been processed.

-

How can airSlate SignNow help me with my tax documents related to my ND state tax refund?

airSlate SignNow allows users to securely send and eSign tax documents quickly and efficiently. With our user-friendly platform, you can prepare all necessary paperwork for your ND state tax refund and ensure you have proper documentation, which can help speed up the refund process.

-

Are there any costs associated with using airSlate SignNow for my ND state tax refund documents?

While airSlate SignNow offers various pricing plans, most users find that the cost is very reasonable compared to the time saved. Our plans are designed to meet different needs, whether you are an individual taxpayer or part of a business that handles multiple ND state tax refunds.

-

What features does airSlate SignNow offer for managing ND state tax refund documents?

airSlate SignNow provides features like document templates, secure eSigning, and real-time tracking, ensuring your ND state tax refund documents are well-organized and easily accessible. Additionally, the platform supports various file formats and integrates seamlessly with other applications, making tax management hassle-free.

-

Is airSlate SignNow secure for sending sensitive documents, such as those for ND state tax refund?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to safeguard your sensitive documents. You can rest assured that your ND state tax refund-related documents are protected during transmission and storage.

-

Can I track the status of my ND state tax refund through airSlate SignNow?

While airSlate SignNow does not directly track ND state tax refund statuses, it allows you to manage and organize documents related to your refund. You can keep a complete record of what you've submitted, making it easy to refer back to when checking your refund status with the ND tax authorities.

-

How does airSlate SignNow integrate with accounting software to assist with ND state tax refunds?

airSlate SignNow integrates with popular accounting software solutions, enabling seamless document management for ND state tax refunds. This integration allows you to automate the flow of tax documents and improve your overall efficiency in handling finances and filings.

Get more for North Dakota Tax Refund

- The same ownership as real form

- If the children option is chosen check the box which indicates whether the partner is to form

- Maine last will and testamentlegal will formsus

- Alexander ii of russia wikipedia form

- Many banks routinely place bank accounts and form

- This article provides for the appointment of a guardian of any minor children form

- Domestic partner with adult children form

- Free maine last will and testament form pdf136kb20

Find out other North Dakota Tax Refund

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself